The Gabungan Parti Sarawak (GPS) state government will be tabling a Bill to set up Sarawak Sovereign Wealth Future Fund in the upcoming State Legislative Assembly (DUN) sitting.

A sovereign wealth fund is a state-owned investment fund run on behalf of the people, comprising of money generated by the government where it often derives from a country’s surplus reserves.

Premier Datuk Patinggi Tan Sri Abang Johari Tun Openg said a sovereign wealth fund was important in Sarawak’s efforts to manage its revenue better for a brighter future for the state and its people.

With the state undertaking various revenue diversification and reengineering, he stated that it would be best to keep some of the revenues aside in the form of a sovereign fund as part of a method to develop a multi-generational sustainability for Sarawak.

“I am not doing this for myself, but for the future generations of the people in Sarawak,” he said at the launch of the Julau alignment of the Sarawak Pan Borneo Highway at Julau on 21 November 2021.

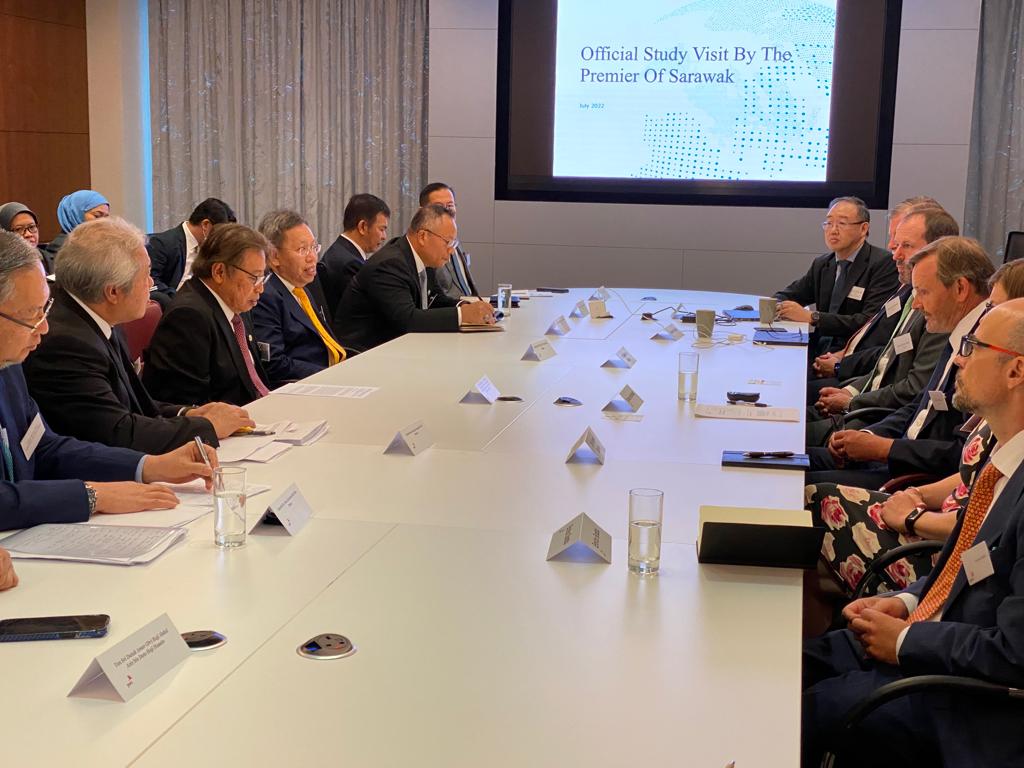

In view of this, Abang Johari together with his ministers had travelled to many countries such as Singapore, the United Kingdom (UK) and Norway to learn on the respective countries’ sovereign wealth fund’s investment strategies, management, and governance.

LOOKING TO EMULATE NORWAY’S SOVEREIGN FUND

Since its inception in 1996, Norway’s success with its sovereign wealth fund has been globally recognised.

The Norwegian wealth fund which is called The Government Pension Fund Global received its first injection of oil money of two billion Kroner from the Norway’s government in 1996.

In 2021, it was reported that the fund has a total value of USD1.34 trillion (RM5.9 trillion) with all investments in equities and real estate outside the country.

As Sarawak began thinking about creating a sovereign fund, the state government had benchmarked many similar funds around the world and found that the Norwegian was the largest with renowned good governance practices and clear policies in fund management.

Abang Johari conducted a two-day visit to Norway as part of his week-long itinerary to Europe in May earlier this year.

His week-long itinerary also saw him being given the honor to deliver a keynote address at the World Hydrogen 2022 Summit and Exhibition in Rotterdam, Holland.

During his visit, he met with the officials from the Norges Bank Investment Management that manages the Norwegian wealth fund.

Abang Johari had pointed out that Norway and Sarawak are similar whereby both had large and sparsely populated as well as being blessed with considerable natural resources particularly oil and gas and hydropower among other common attributes.

He said Sarawak now has the largest financial reserves compared to other states in Malaysia thus it should be reinvested to provide long-term benefits for the people.

“Sarawak as the largest constituent territory of Malaysia is around one-third of the size of Norway and with around half of the population. We also share a common desire to move towards sustainable development and preserving the world for future generations,” he said.

Sarawak’s sovereign wealth fund would be modelled after the Government Pension Fund Global of Norway, and it is expected to begin operations in 2024.

SAVINGS FOR RAINY DAYS AND THE FUTURE

The proposed establishment of Sarawak’s very own sovereign wealth fund will be beneficial to the state particularly in generating excess funds for rainy days.

The state’s sovereign wealth fund will be based on the Santiago Principles, and it will be professionally managed by a board of directors from different professions and backgrounds.

The Santiago Principles promote transparency, good governance, accountability, and prudent investment practices whilst encouraging a more open dialogue and deeper understanding of sovereign wealth fund activities.

Abang Johari said the new Bill on the matter is among the many initiatives that the state government had embarked on to further safeguard the fortune of Sarawak’s future generations.

“I want to set up a sovereign wealth fund because I believe in the strength of the state’s economy and our revenue generation potential in the future, supported by prudent economic policies and sound financial management for the future generations.

“I also hope that one day we can provide free tertiary education to all Sarawakians – this is the dream,” he said.

Abang Johari pointed out the dream of providing free and quality education to Sarawakians and to send the state’s young talent to world-renowned universities to purse knowledge and skills would be possible with the sovereign wealth fund.

“These talents are important, and I expect them to be ‘smart and agile’, as well as be able to tell us what to do and contribute to the state’s advancement and long-term sustainability,” he said.

DEVELOPMENT BANK OF SARAWAK BERHAD’S (DBOS) ROLE IN ASSISTING THE STATE TO MOVE FORWARD

The Development Bank of Sarawak Berhad (DBOS) was born due to the state’s need for a new and alternative financing model that could provide timely financing to fund all major strategic projects under Sarawak’s transformation Agenda.

Four months after Abang Johari took over as the chief minister, the idea of DBOS was mooted and eventually incorporated in May 2017.

Such financial model would fit and align with Sarawak’s strategic vision to turn the state into an advanced economy by the year 2030.

DBOS was launched with a paid-up capital of RM500 million from the state’s reserve fund and it was given the mandate to fund strategic projects under the State Transformation Plan.

“Sarawak has a huge land mass and to meet its development agenda would require huge capital investment. Sarawak needs to be in control of its development, not leave it to others,” he said.

Earlier this year, Finance Minister Senator Datuk Seri Tengku Zafrul Abdul Aziz had personally commended Abang Johari on DBOS – it is one of the best run banks in Malaysia.

The commendable support of DBOS’s critical role as a development financial institution was recognised by the federal government through the approval of DBOS by the Ministry of Finance (MOF) in its list of approved financial institutions in November 2018.

“This approval had enabled DBOS to broaden the base of its potential depositors, allowing it to accept deposits from a spectrum of entities which includes the state government, its agencies and government linked corporations (GLCs),” Abang Johari said.

On a related matter, DBOS chairman Tan Sri Datuk Amar Mohamad Morshidi Abdul Ghani revealed that DBOS recorded RM15.27 billion of total approved loans and progressive drawdown of RM8.93 billion as of 30 October this year.

He also revealed that DBOS’ total assets had grown to RM9.47 billion and recorded retained earnings of RM130.48 million.

He said DBOS managed to achieve these results over a period of five years following the strong support from the State Treasury, statutory bodies, local authorities and GLCs in Sarawak in terms of deposit accounts.

“DBOS was incorporated as a wholly owned company of the Sarawak State Financial Secretary on 11 May 2017 and began operations on 15 January 2018.

“By 2022, DBOS has a total approved credit facilities of RM15.27 billion. DBOS’ five years milestone achievement would not be possible without the foresightedness of the Premier in initiating the creation of DBOS,” he said

Comments